But when one large US bank acquired a competitor with a substantial geographic overlap, the acquirer suffered unusually high losses among the target company’s customers, rendering the deal unprofitable and exposing the merged entity to a takeover. The acquiring bank assumes that while some customers might leave, cost savings will more than make up for the losses. In retail banking, for example, important cost-based synergies are expected to come from consolidating branch networks. These dis-synergies sometimes result from the disruption of a company’s ability to execute and sometimes directly from efforts to Almost 70 percent of the mergers in our database failed to achieve the synergies expected in this area (Exhibit 1).Īnother common reason for errors in estimating revenues is the failure of most acquirers to account explicitly for the revenue dis-synergies that befall merging companies. Pursued to gain access to a target’s customers, channels, and geographies. The greatest errors in estimation appear on the revenue side-which is particularly unfortunate, since revenue synergies form the basis of the strategic rationales for entire classes of deals, such as those

Wall Street wisdom warns against paying for revenue synergies, and in this case it is right.

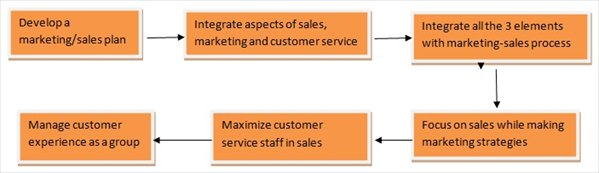

When applied by an acquisition team chosen for its expertise and its ability to counter gaps in information, these six measures should help buyers avoid the winner’s curse and improve the quality of most of their deals. Additional steps include vetting assumptions about pricing and market share, making better use of benchmarks to deliver cost savings, and forming more realistic assessments of how long it will take to capture synergies. They should also try to anticipate common “dis-synergies” (such as the loss of customers and difficulties reconciling different service terms) and consider raising their estimates of onetime costs. As our database expands, we will continue to deepen our understanding of realized merger synergies and share the insights that emerge.After combing through the data from 160 mergers (so far)-as well as our knowledge of the companies and their industries-we have found six practical measures that executives can take to improve the chance of achieving synergies from acquisitions.įor starters, executives should cast a gimlet eye over estimates of top-line synergies, which we often found to be inflated. To address this challenge, we have used our extensive experience of postmerger integration efforts across a range of industries, geographies, and deal types to set up a database of estimated and realized merger synergies. Fewer still get involved in the postmerger work, when premerger estimates come face-to-face with reality. And external transaction advisers-usually investment banks-are seldom involved in the kind of detailed, bottom-up estimation of synergies that would be needed to develop meaningful benchmarks before a deal. Even highly seasoned buyers rarely capture data systematically enough to improve their estimates for the next deal. To help them assess synergies and set targets, they usually have little data about the target company limited access to its managers, suppliers, channel partners, and customers and insufficient experience. However, it takes only a very small degree of error in estimating these values to cause an acquisition effort to stumble.Īcquirers must undoubtedly cope with an acute lack of information. These synergies can come from economies of scale and scope, best practice, the sharing of capabilities and opportunities, and, often, the stimulating effect of the combination on the individual companies. Thaler, The Winner’s Curse: Paradoxes and Anomalies in Economic Life, Princeton, New Jersey: Princeton University Press, 1992. Our exploration of postmerger integration efforts points to the main source of the winner’s curse: the fact that the average acquirer materially overestimates the synergies a merger will yield. Hans Bieshaar, Jeremy Knight, and Alexander van Wassenaer, “Deals that create value,” The McKinsey Quarterly, 2001 Number 1, pp. The fact is well established, but the reasons for it are less clear. Indeed, on average, the buyer pays the seller all of the value generated by a merger, in the form of a premium of from 10 to 35 percent of the target company’s preannouncement market value. When companies merge, most of the shareholder value created is likely to go not to the buyer but to the seller.

0 kommentar(er)

0 kommentar(er)